If you’ve been following our Money Talks Finance Series, you know Johnny’s written a Fundrise review before. We dedicate a lot of time to ensuring the decisions we make will help us achieve financial freedom one day. Fundrise’s real estate investment platform has been a game changer for us, and I’m excited to share our experience with you!

Accessibility

Johnny started investing with Fundrise as a newly minted college grad. This was long before they became the largest direct-to-investor real estate investment platform with $7 billion in transactions. Obviously neither of us had a lot of money then, but he was really interested in real estate investing and put in $1,000. Real estate investing minimums can be $25,000 to go in on one apartment complex, but Fundrise’s is just $10.

Efficiency

When we tell people we’re investing in real estate, they always comment on how hard it must be. They’re amazed once we give them our Fundrise review! Being able to invest in high quality real estate without any work is so ideal for us. Between caring for my Dad, working as much as we do, and the fact that neither of us are at all handy, actually purchasing real estate and committing to all the maintenance would be near impossible.

Quality

We never have to wonder what’s going on with our investments because the communication is phenomenal. When you sign up, you’re able to see the portfolio, its performance, and their track record. You’re also able to get updates on every project and your dividends and returns. Their access to private real estate deals across the United States is unmatched, so you can feel good about where you’re putting your money.

Returns

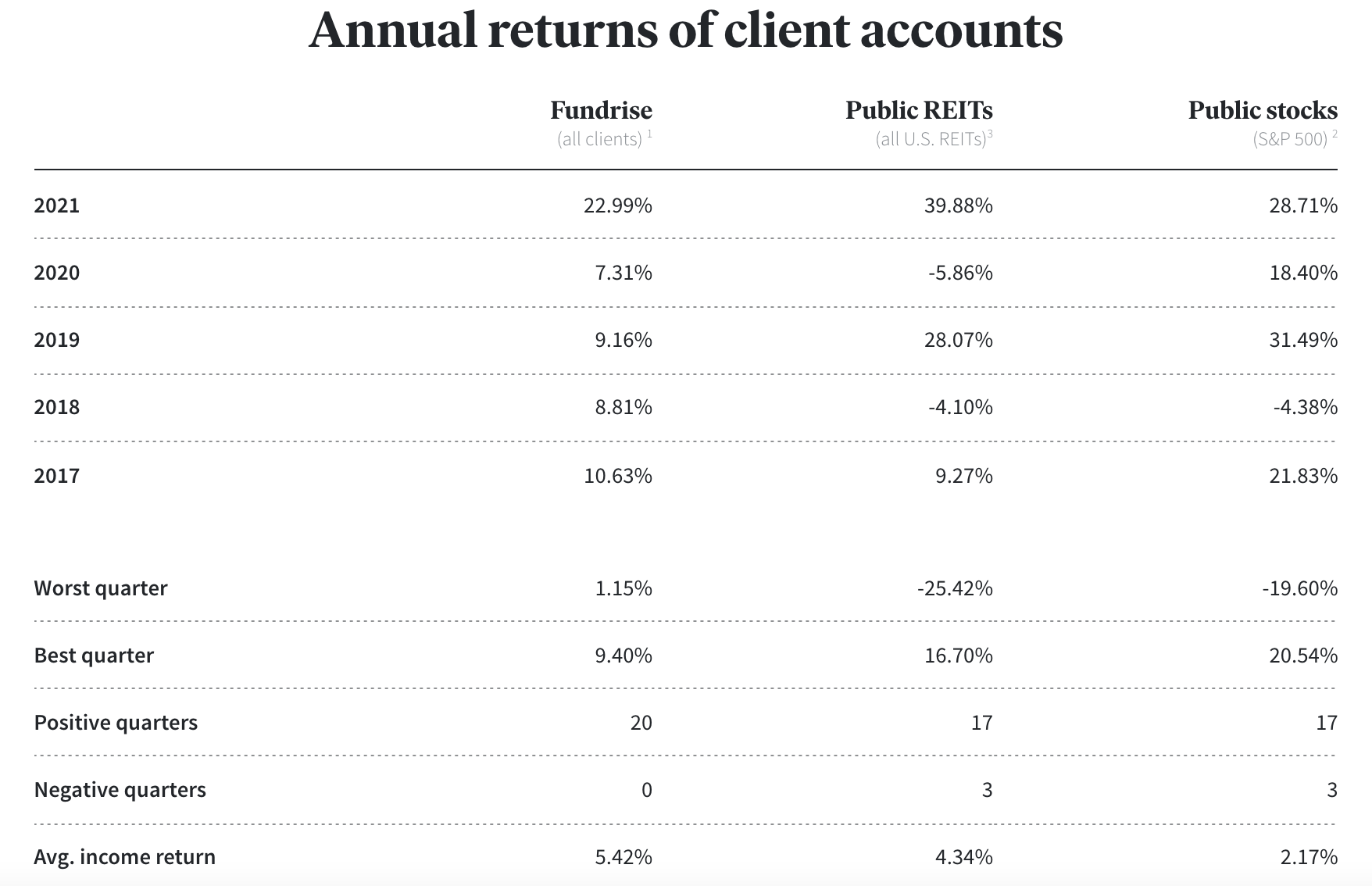

Johnny and I both believe in making decisions now that will benefit our future selves. When we bought our house, it was investments like Fundrise that helped us put together a downpayment. Our returns are on par with Fundrise’s reports, which we’ve been really happy with. There’s two things I think help this, which is the diversification of real estate opportunities and the inability to pull your money out, which is actually good because you can’t psych yourself out and miss out on the long-term returns.